Written by Dr Sugumar Mariappanadar, Senior Sustainability Advisor, Insync and Board Benchmarking – as part of our latest report ‘Benchmarking board performance: 500 board reviews later‘.

In the new emerging world of Net Zero and the increasing measurement of corporate environment, social and governance (ESG) sustainability performance, boards are under increased pressure from global sustainability standards (i.e., IFRS – ISSB, GRI etc.,) and key stakeholders to transform their corporate business strategies and disclose material ESG performance.

Recently, an ESG risk rating analysis by S & P Global indicated that 4.5% of the world GDP could be lost due to climate risk which is likely to lead to increases in the interest bills on corporate debt by billions of dollars annually.

4.5% of the world GDP could be lost due to climate risk.

In a recent comprehensive survey of more than 150 directors and executives of large ASX and other organisations Board Benchmarking found that:

• Only 46% of the executives agreed or strongly agreed that the board had the appropriate level of expertise and experience to help drive their organisation’s ESG aspirations and performance. The percentage was much higher at 74% for directors.

• Only 57% of directors and 60% of executives agreed or strongly agreed that the board has appropriate oversight of plans to mitigate ESG risks and take advantage of ESG opportunities, including in relation to climate change.

• Only 40% or directors and executives agreed that the board is clear about the steps their organisation should take to best position it in a Net Zero world.

Clearly, more needs to be done by boards to develop their ESG expertise and experience to better oversight ESG and assist their organisations to respond strategically to the complex pressures imposed by the key stakeholders on their organisation’s ESG sustainability performance.

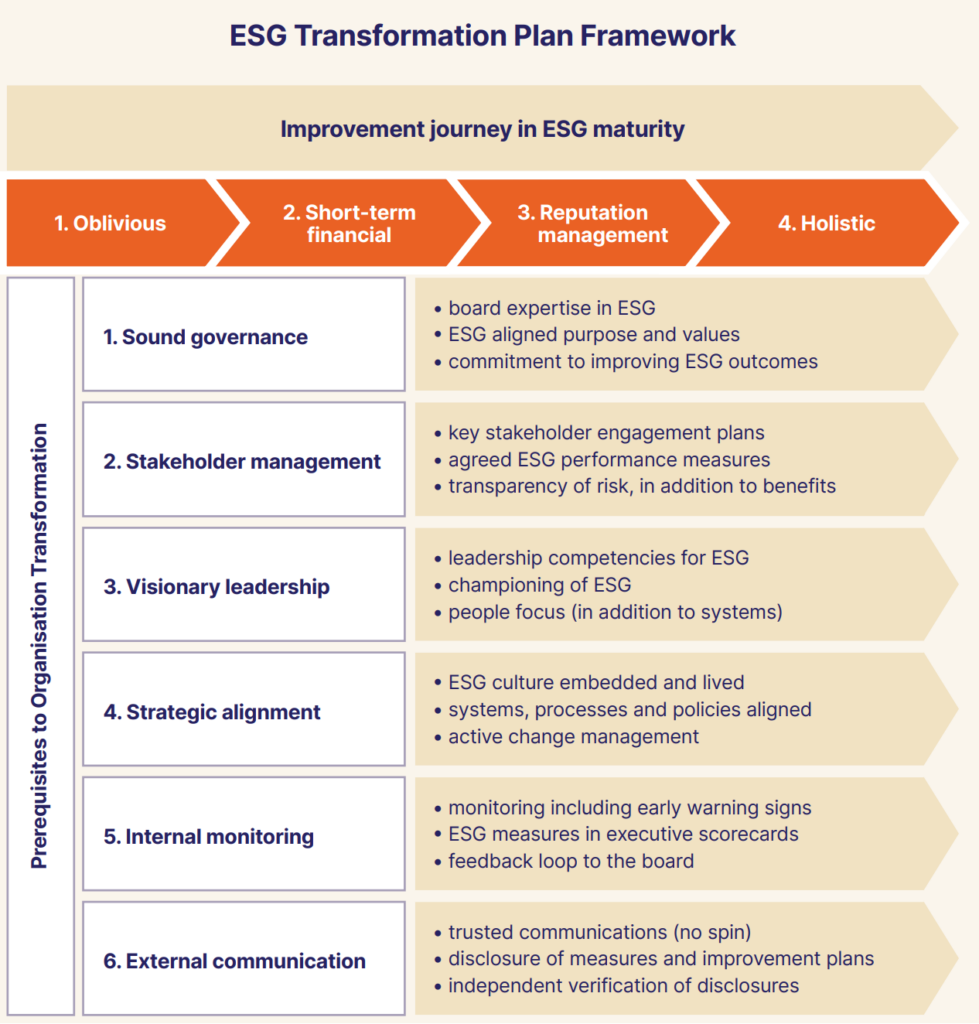

If organisations are to best position themselves in a Net Zero world a more holistic and strategic approach to ESG performance is likely to be required. To achieve this many organisations will need to rewire their structure, policies, culture, systems, processes and management approaches to better align with their new ESG sustainability ambitions and performance objectives.

The transformation journey, including this reassessment and realignment process, is likely to take organisations at least three to five years, with significant measurable progress likely to be identifiable within one to two years.

Board Benchmarking’s ESG Transformation Plan Framework will assist organisations on their journey and steering them away from green–and–white-washing. This ESG Transformation Plan Framework is included in Board Benchmarking’s ESG whitepaper.

Board Benchmarking has included several ESG resources on its website including access to expert advice and surveys to measure and improve ESG Maturity, ESG Capability and to achieve ESG Best Practice.

Only 57%, agree or strongly agree ‘the board has appropriate oversight of plans to mitigate ESG risks and take advantage of ESG opportunities (including in relation to climate change)’.