Insync, in association with Board Benchmarking, has designed two new Environmental, Social and Governance (ESG) surveys to measure an organisation’s ESG performance from the inside objectively. These measures are an essential addition to the current popular external measures of ESG performance based on questionnaires and published reports.

Current performance measures are often exaggerated

S&P Global Corporate Sustainability Assessment (CSA) and Morgan Stanley’s Capital International (MSCI) sustainability assessment ratings are two of the most popular ratings of company’s Environmental, Social and Governance performance.

S&P Global CSA and MSCI measure the ESG performance of companies through questionnaires and by reviewing secondary published information from annual reports, corporate social responsibility (CSR) reports or Global Reporting Initiatives (GRI) for sustainability reports.

However, repeated research evidence and media reports have highlighted that companies tend to exaggerate ESG performances unintentionally or intentionally in their published CSR reports, which is commonly referred to as “greenwashing” and “whitewashing”. Any exaggerated claims of ESG performance credentials of companies distort financial risks and strengths of investment decisions.

2 new Surveys designed to objectively measure ESG performance from the inside

Insync, in association with Board Benchmarking, has designed two new surveys to measure an organisation’s ESG performance from the inside objectively. These two new surveys have been developed based on research evidence and the ESG sustainability standards of GRI, UN Compact and Sustainability Accounting Standards Board (SASB).

These two surveys, the ESG Maturity Calibration Survey and the ESG Capability Survey will help organisations proactively plan, implement, and objectively capture enterprise-wide management risk factors for ESG that have potential negative (positive) impacts on an organisation’s reputation and financial performance.

1. ESG Maturity Calibration Survey

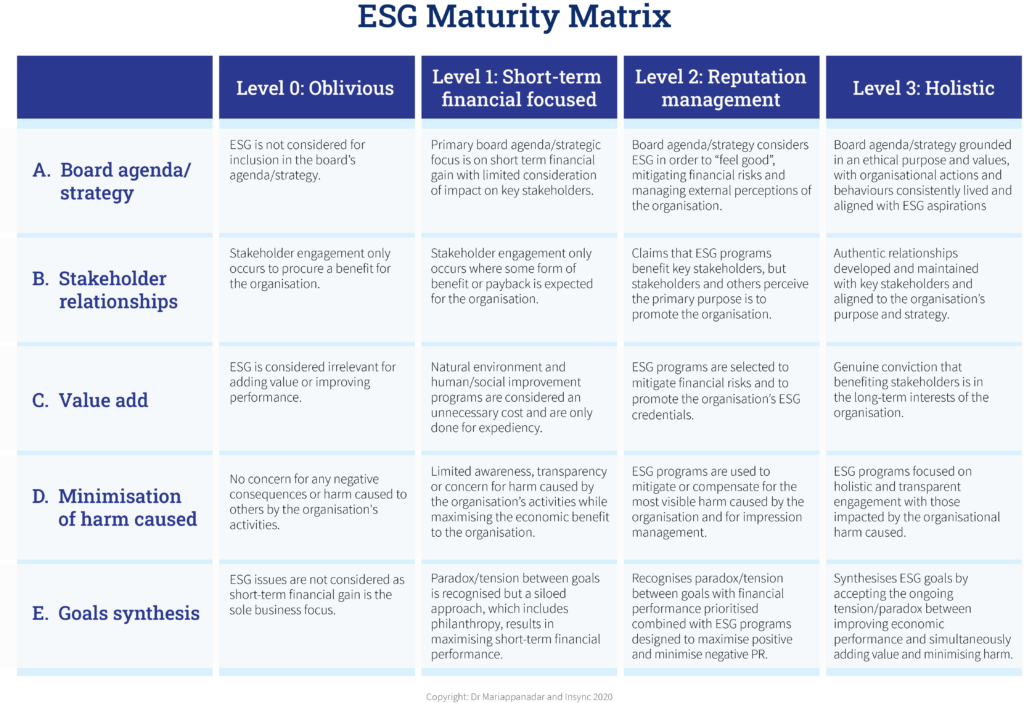

The ESG Maturity Calibration Survey is designed for senior executives and the board to calibrate their organisation’s level of ESG maturity based on their organisation’s activities and management approaches across five different dimensions of the following ESG Maturity Matrix. As well this survey assesses the organisation’s current state of maturity it also measures the desired level of maturity in, say, three years.

The organisation’s investors, analysts and proxy advisors can also complete the ESG Maturity Calibration Survey. Therefore, the external view of an organisation’s current and desired level of maturity can be compared with the internal view of its executive and board and the reasons for differences in perceptions dealt with.

2. ESG Capability Survey

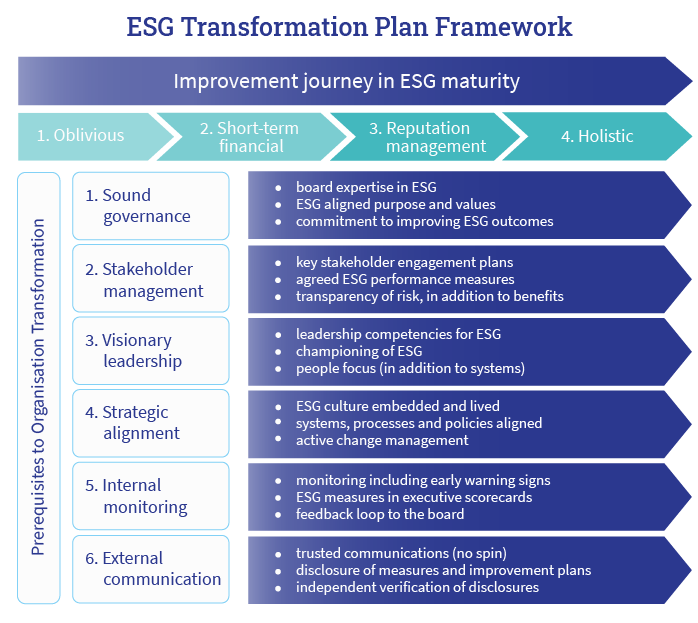

Designed for senior executives and the board, The ESG Capability survey allows assessment of the organisation’s level of capability across each of the six dimensions of ESG capability. The survey is based on the following ESG Transformation Plan Framework.

The results of the ESG Capability Survey will guide an organisation’s transformation journey. The results allow for alignment of its activities and management approaches to achieve the desired level to mitigate reputational and financial risks.

This article demonstrates the importance of using internal surveys to objectively measure your ESG performance. The ESG Maturity Calibration Survey shows you your current maturity level and where you aspire to be in three years. The ESG Capability Survey shows you the extent of your current capability and where you need to improve to reach your desired performance.